Windstream?s tax break is just not REIT

Windstream is a diversified telecommunications corporation based in Little Rock, Arkansas, which takes in $6 billion a year revenues. But in a never-ending search for greater profits, Windstream has decided to take advantage of a recent and little-known ruling by the IRS.

This allows the company to spin off its wire and fiber based networks, and all the land and infrastructure, into a real estate investment trust, or REIT. This unprecedented change in status could mean a tax savings of some $250 million a year for Windstream.

Now, REITs have been around since the 1960s, and were modeled after mutual funds. According to REIT.com, these instruments were created by Congress to “give all Americans – not just the affluent – the opportunity to invest in income-producing real estate in a manner similar to how many Americans invest in stocks and bonds through mutual funds.”

However, the rules for the past half-century have mandated that the company invest 75 percent of its total assets in real estate, and derive 75 percent from real estate sales, rents and mortgages. But the new IRS ruling says assets may now include “...microwave transmission, cell and broadcast towers as well as parking facilities, bridges and tunnels, railroad tracks, transmission lines, pipelines and storage facilities.”

Not everyone agrees that this new ruling is beneficial to the nation. “The rules were intended to help people like you and me buy a share in an office building, if we want to own real estate assets,” Rebecca J. Wilkins of Citizens for Tax Justice told The New York Times. “If we want to invest in Windstream’s copper and fiber networks we can already buy a share of Windstream,” she added.

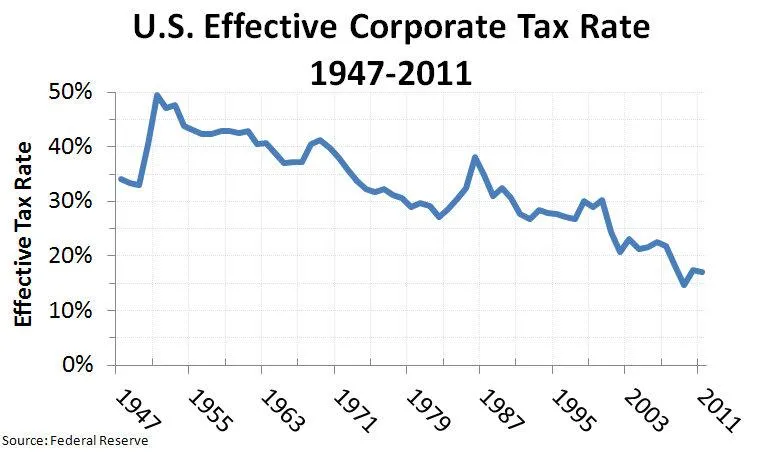

Moreover, Citizens for Tax Justice found that telecoms did not need further tax breaks. From 2008 through 2012, they paid an average tax of under 10 percent, well below the standard corporate tax rate of 35 percent.

Nevertheless, if the IRS ruling stands, and Windstream realizes its quarter-billion in savings, we might see other telecoms – as well as cable companies and utilities – convert assets to REITs.

Windstream Corporation (NY Times profile)

What is a REIT? (REIT.com)

A Corporate Tax Break That’s Closer to Home (NY Times, Aug. 9, 2014)

CWA members oppose AT&T’s attempts to stop serving rural and low-income communities in California

CWA urges FCC to deny industry attempts to loosen pole attachment standards

CWA District 6 reaches agreement with AT&T Mobility